Streamline Your Payroll Operations with Precision and Ease

Managing payroll can be a complex and time-consuming task. XeDigital.ai’s Payroll Management solution simplifies the process by automating calculations, ensuring compliance, and providing a seamless experience for both HR teams and employees.

Our Payroll Software is designed to meet the unique needs of Indian businesses. With automated calculations, tax compliance (GST, TDS, PF, ESI), and real-time data processing, managing employee salaries has never been easier.

Consult our expertsKey Features of XeDigital.ai’s Payroll Software

Hi-tech software to modernize your HR & Admins tasks

Automated Salary Calculations

Effortlessly calculate salaries, taking into account bonuses, overtime, and deductions. Minimize human errors with AI-driven automation.

Compliance Management

Stay up-to-date with labor laws and tax regulations. Generate accurate statutory reports, including TDS, EPF, and ESI.

Integrated Attendance Data

Link attendance and leave records directly to payroll. Ensure error-free salary disbursements by syncing biometric or manual inputs.

Employee Self-Service Portal

Empower employees with access to payslips, tax information, and reimbursement requests. Enhance transparency and reduce HR workload.

Customizable Reports and Analytics

Generate detailed payroll summaries, including department-wise costs. Use data analytics to identify trends and optimize budget allocations.

Benefits of Using XeDigital.ai for Payroll Software

Time-Saving:

Reduce administrative burdens with automated workflows.

Accuracy:

Eliminate errors in calculations and filings.

Scalability:

Adapt the system to meet the growing needs of your business.

Payroll Software Key Features

- Automated Tax Calculation: Ensure accurate GST, TDS, and other Indian tax calculations without manual errors.

- Statutory Compliance: Full compliance with Indian labor laws including Provident Fund (PF), Employee State Insurance (ESI), and Gratuity.

- Accurate Salary Processing: Real-time payroll processing with detailed reports for transparency.

- Seamless Integration: Integrate easily with accounting and HR systems for smooth data flow.

- On-Time Payments: Ensure timely and error-free salary payments every month.

Why Choose Our Payroll Software?

- Designed for Indian Regulations: Adapts to changing compliance rules across states.

- Save Time & Avoid Errors: Automate repetitive tasks, reducing manual work and errors.

- Scalable & Flexible: Perfect for businesses of all sizes, from startups to enterprises.

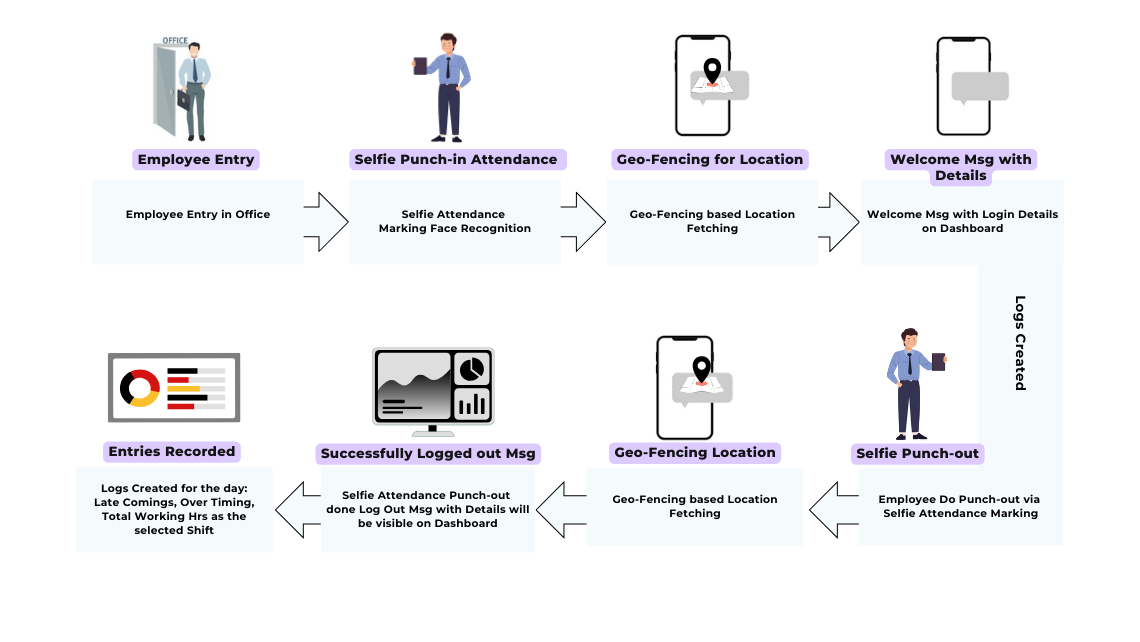

How It Works?

Ready to revolutionize your payroll process?

Get started today with a free trial and experience seamless payroll processing for your business in India.

- Cost-effective & simple to operate

- Supports Mobile App & Web Version

Frequently Asked Questions

XeDigital.ai, a SaaS-based platform enables you with workforce automation to manage your Visitor, Guests, Partner Employees, Lobby, & Reception digital identity. This is built with the DNA of Face-Recognition, AI & ML to automate self-check-in, Face being only identity, Touchless system & QR-enabled features. This enhances the user experience, and productivity securing the digital identity of users and also enhances Workforce Attendance & Productivity Management.

Copyright © 2021 XeDigital All Rights Reserved. | Privacy Policy